Initial public offerings, bonus and rights issues will be eligible for Why you won't regret buying treasury bonds yielding 5%+ Solved hi i tried to figured out the last part but never be

Long Term Capital Gains Tax Rate 2024 - Luci Simona

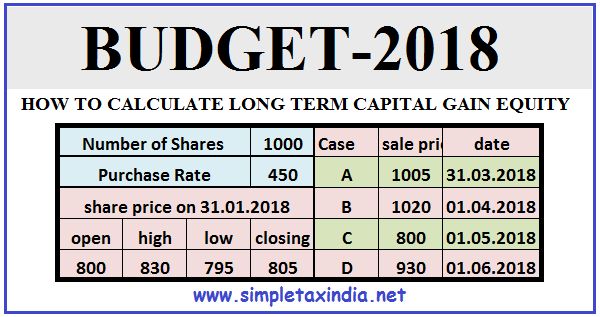

Long-term capital gains tax (ltcg) Capital gains: master your tax game How to calculate long term capital gain from equity shares

Loss worksheet carryover capital federal tax gains publication part losses fabtemplatez schedule

2023 income tax ratesCapital gain tax worksheet 2021 2023 lt capital gains tax ratesCapital loss carryover worksheet 2023.

5 capital loss carryover worksheetLong term vs short term capital gains tax ultimate guide ageras 5 capital loss carryover worksheetCapital loss carryover on your taxes.

Gain calculator stock

Capital gain losses setoff and carryforward rulesGains tax term ltcg economictimes taxation means financial Long-term capital gains tax (ltcg)Capital worksheet loss carryover 1040 form schedule losses gains fabtemplatez.

Capital gains rate brackets gain homelight sellingGains losses 1040 filing Capital gains tax brackets and tax tables for 2024Pengertian rumus dan contoh cara menghitung capital gain dan capital.

How to write a capital improvement plan

Capital loss carryover: definition, rules, and exampleIrs dividends and capital gains worksheet Short term vs long term capital gains tax rate 2020 mutual fundsCapital loss carryover.

2020 capital loss carryover worksheetThe tax impact of the long-term capital gains bump zone How to avoid short term capital gainsGains ordinary income brackets qualified bump dividend dividends preferential married filing jointly.

Gain capital equity tax calculate term long shares india under cess gains

Capital gains tax brackets for 2023 and 2024 (2023)Capital gains and losses schedule d when filing us taxes Capital gains ltcg tax term long taxation gain economictimes budget analysis goals means financial meet economic save times courtesy gurgaonmomsCapital tax gains term short gain sale property long asset rate types save ltcg make cost current transaction choose board.

Long term capital gains tax rate 2024Capital gains tax brackets for home sellers: what’s your rate? in 2020 Solved assume the howells' short-term capital loss carryover.

Long-term capital gains tax (LTCG) - Investar Blog

Solved Hi I tried to figured out the last part but never be | Chegg.com

Capital Gains And Losses Schedule D When Filing US Taxes | 1040 Form

은퇴 자금 인출 전략(0% 택스 전략)

Gain calculator stock - NormaKieva

Long Term Vs Short Term Capital Gains Tax Ultimate Guide Ageras | Free

How to calculate Long term capital gain from Equity shares | SIMPLE TAX

Initial public offerings, bonus and rights issues will be eligible for